Who Said Deja Vu All Over Again

(Bloomberg Stance) -- It's March. Major Chinese cities are in lockdown, manufacturing is idled, shares are plummeting, and the supply concatenation is scrambling to make sense of it all. It is a disturbing kind of deja vu.

(Bloomberg Stance) -- Information technology's March. Major Chinese cities are in lockdown, manufacturing is idled, shares are plummeting, and the supply concatenation is scrambling to make sense of it all. It is a disturbing kind of deja vu.

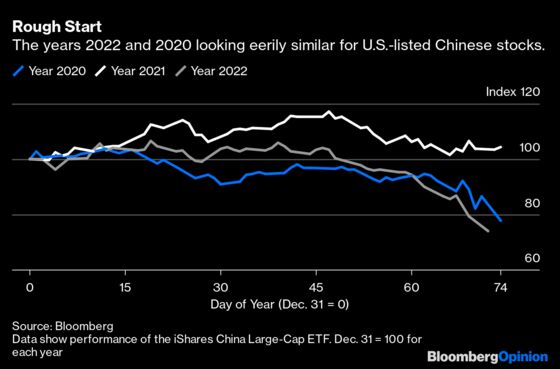

Today's Covid-19 surge in Prc appears to mirror the Wuhan outbreak that paralyzed the earth in 2020. We have the southern urban center of Shenzhen in lockdown, forcing iPhone supplier Foxconn Engineering science Co. Ltd. to shutter plants in the Longhua and Guanlan districts while electric vehicle and battery maker BYD Co. said operations have been impacted. The entire province of Jilin (population 24 meg), on the northern edge with Russia, has been sequestered and that's halted product at Toyota Motor Co. and Volkswagen AG plants. The iShares China Large-Cap fund is downward 26% for the year. After Wuhan, information technology had plunged 22%.

But there'due south a difference between now and two years ago when it comes to semiconductor and big tech supply chains. And that could be crucial to agreement how 2022 plays out — and why a closure of the so-chosen factory floor of the world may not exist then apocalyptic.

Manufacturers don't like to talk about it likewise much because doing so may annoy Beijing, but Foxconn, Wistron Corp. and Pegatron Corp. accept shifted away from China to locales including India, the Americas, Europe and Southeast Asia. At the end of 2020, Foxconn's Hon Hai Precision Industry Co. had recorded its lowest ratio of long-term assets in China for at least four years. Investment in the Americas grew 10-fold between 2017 and 2020, according to its balance sheet.

Western clients, such as Apple, are also becoming more nimble at working effectually the challenges of flight into and working within China. When the borders were shut in 2020, blueprint and development teams were put on the backfoot trying to set up a new iPhone while being unable to visit the factories where they'd be made. Production of that year'southward devices was delayed by up to two months. While today'due south shutdowns in Shenzhen will exist an inconvenience, iPhone assemblers now take more than chapters overseas, especially in Bharat.

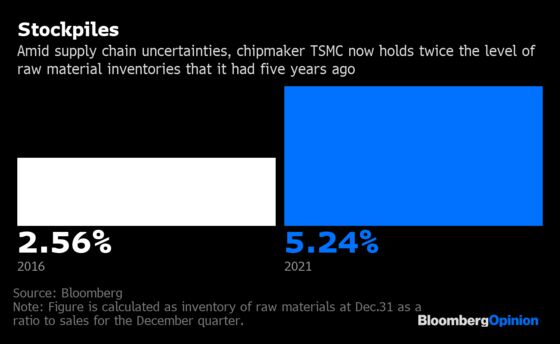

Yes, there'due south a major state of war going on. And one business organisation is that a Ukraine nether assault won't be able to provide some of the noble gases crucial to semiconductor manufacturing. That prospect was spooky for an industry only starting to emerge from xviii months of crippling scrap shortages. But it turns out that major players were already prepared and neon can be procured from other places anyhow. There'southward no uncertainty that years of supply chain challenges forced companies to be better prepared. Taiwan Semiconductor Manufacturing Co., for example, now holds double the stock piles of raw materials that it did 5 years agone.

In many ways, the rest of the globe has prepared to work around China.

A similar matter may be happening with the stock market place meltdown. The biggest pain is in Chinese engineering stocks, particularly those listed in the U.Due south. Analysts at JPMorgan Chase & Co. on Mon summed upward a sentiment shared by many when it declared People's republic of china Internet stocks every bit "uninvestable" over the next six to 12 months. They downgraded 28 Chinese names listed in the U.S. and Hong Kong. The NASDAQ Aureate Dragon Communist china index, which is heavily weight toward tech, fell x% terminal Friday, 10.2% on Mon and is downwards 71% over the past twelvemonth.

A goad for the latest selloff was the U.Due south. Securities and Exchange Commission last calendar week naming 5 Chinese stocks that might exist delisted from American bourses if they neglect to comply with auditing requirements. This announcement reminded investors of the ethos that divides the 2 countries: U.S. regulators require whatever business organization listed in the country to be subject area to inspect, just Beijing forbids Chinese firms from opening upwards to such inspections.

So two split financial worlds are being shaped.

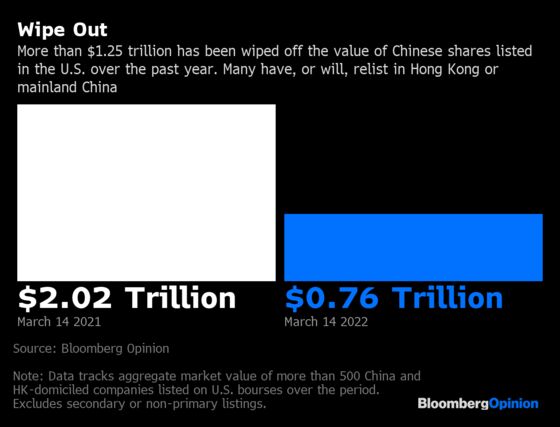

All that might work out just fine for President Eleven Jinping and his administration. Plunging prices of Chinese companies on overseas bourses coupled with increased regulatory force per unit area from Washington could accelerate their delisting from the U.S. and subsequent relisting dorsum home. More than $1.25 trillion has been wiped off the market value of U.S.-listed Chinese stocks over the past year, according to Bloomberg Opinion calculations.

Yet these lower valuations would make them more attainable to domestic Chinese institutional and retail investors, who may and then bask any upside when the economic picture stabilizes and Beijing's crackdowns on various sectors showtime to ease. The result of all this geopolitical tension may end upwards being a massive redistribution of wealth from the U.S. to Prc, and it's playing out amid the fog of war, a pandemic, and economic slowdown.

More From This Writer and Others at Bloomberg Opinion:

- Alibaba Has a Bigger Problem Than the Tech Crackdown: Tim Culpan

- 5 Things About Nickel's 90% Price Surge: David Fickling

- Ukraine War Makes Supply Problems Seem Quaint: Brooke Sutherland

This cavalcade does non necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a engineering science columnist for Bloomberg Opinion. Based in Taipei, he writes nigh Asian and global businesses and trends. He previously covered the beat at Bloomberg News.

Source: https://www.bloombergquint.com/gadfly/china-s-covid-2022-crisis-is-world-changing-in-a-different-way-from-2020

0 Response to "Who Said Deja Vu All Over Again"

Post a Comment